Accessibility Links

By browsing our website, you accept the use of cookies. Our use of cookies is explained in our privacy policy.

January 2025 market review: International

Read how US sanctions on Russia and Iran, and the release of the latest version of China's AI model impacted international markets during January 2025.

Brace for disruption

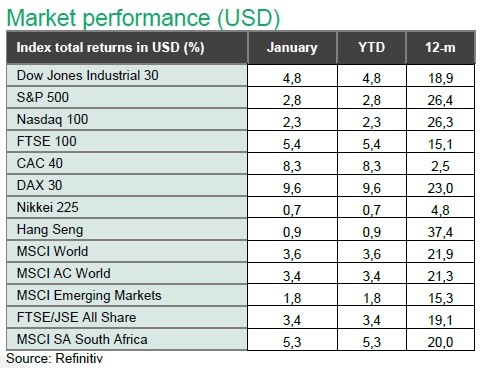

Equity and bond markets started the year on a positive note, despite elevated levels of volatility. US equity markets underperformed other developed market peers as technology stocks lost ground following the release of the latest version of Chinese artificial intelligence model, DeepSeek, which revealed greater efficiency at a lower cost (using fewer advanced chips) relative to the current US industry leaders. Chip-maker, Nvidia lost nearly $600 billion on 27 January, one of the largest one-day drawdowns in US market history. The company subsequently regained its footing, but still lost 10,6% over the month. The sector has been trading at high valuations, spurred by the future earnings potential of artificial intelligence and other technological advances.

Sanctions on Russia and Iran by the US, alongside cold weather in the Northern Hemisphere saw oil prices rise in January. President Trump used his address at the World Economic Forum to urge OPEC members to “bring down the cost of oil” which delivered some retracement in pricing. All in all, the oil price increased by 2,8% over the month.

US inflation data painted a mixed picture. US headline inflation rose for a third consecutive month to 2,9% y-o-y in December, broadly in line with expectations, while core inflation eased to 3,2%. Producer prices printed at 3,3% from 3,0% the prior month, coming in below expectations. Data for the US personal consumption expenditure price index (PCE) was recorded at 2,6%, the highest in seven months. The annual rate for core PCE (the Fed’s preferred measure of inflation) remained steady at 2,8%.

The US Federal Reserve (US Fed) kept policy rates on hold, in line with market expectations. Federal Reserve Chair, Jerome Powell remarked on somewhat elevated levels of inflation, while removing reference to progress on meeting the 2% inflation target. With several references to policy uncertainty, the US Fed Chair indicated the potential for an extended pause and that the committee “does not need to be in a hurry to adjust our policy stance”. The US 10-year bond yield reached highs of 4,8% over the month but settled at 4,5%.

Inflation for the Euro area increased to 2,5% y-o-y in January from 2,4% the previous month, driven by rising energy costs. The European Central Bank (ECB) cut interest rates by 0,25%, warning of “headwinds” for the region which has been mired in weak economic growth. UK bond yields surged to levels last seen during the Russian financial crisis, as the implication of higher borrowing costs caused even higher bond yields. UK inflation printed at 2,5% in December from 2,6% the previous month, calming the domestic bond market. Widely expected, the Bank of Japan (BoJ) bucked the trend with a 25bps interest rate hike. Chinese inflation printed at 0,1% over the year from 0,2% the prior month, suggesting stimulus has yet to reap any benefits against a weak economic backdrop and deflationary pressures.

Sovereign bond markets started the year under duress, as higher global bond yields reflected pared back interest rate expectations and implications of a new US administration. A downside surprise to US inflation and the sell off in US technology shares saw the pressure on bond yields subside while a tightening in credit spreads drove positive returns across high yield and investment grade markets. The Bloomberg Global Aggregate Bond index gained 0,6% in January. Gold benefitted from the precarious global backdrop, gaining 6,8% in the first month of the year. The US dollar ended the first month of 2025 modestly weaker, depreciating by 0,1% on a trade weighted basis.

Want to know more?

Here's what to do:

- Contact your wealth manager or stockbroker.

- To find out more about our investment offering, click here.

- If you're interested in what we can offer you, we would love to hear from you. You can contact us on 0800 111 263, or complete an online contact form.

| Disclaimer |

Nedgroup Private Wealth (Pty) Ltd and its subsidiaries (Nedbank Private Wealth) issued this communication. Nedgroup Private Wealth is a subsidiary of Nedbank Group Limited, the holding company of Nedbank Limited. ‘Subsidiary’ and ‘holding company’ have the same meanings as in the Companies Act, 71 of 2008, and include foreign entities registered in terms of the act. There is an inherent risk in investing in any financial product. The information in this communication, including opinions, calculations, projections, monetary values and interest rates, are guidelines or estimations and for illustration purposes only. Nedbank Private Wealth is not offering or inviting anyone to conclude transactions and has no obligation to update the information in this communication. While every effort has been made to ensure the accuracy of the information, Nedbank Private Wealth and its employees, directors and agents accept no liability, whether direct, indirect or consequential, arising from any reliance on this information or from any action taken or transaction concluded as a result. Subsequent transactions are subject to the relevant terms and conditions, and all risks, including tax risk, lie with you. Nedbank Private Wealth recommends that, before concluding transactions, you obtain tax, accounting, financial and legal advice. Nedbank Private Wealth includes the following entities: |

Additional Information

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.