Accessibility Links

By browsing our website, you accept the use of cookies. Our use of cookies is explained in our privacy policy.

February 2025 market review: International

US equity markets stumbled over the month, while European markets fared better and Chinese technology stocks rallied strongly. Read the latest international market review.

Growing unease

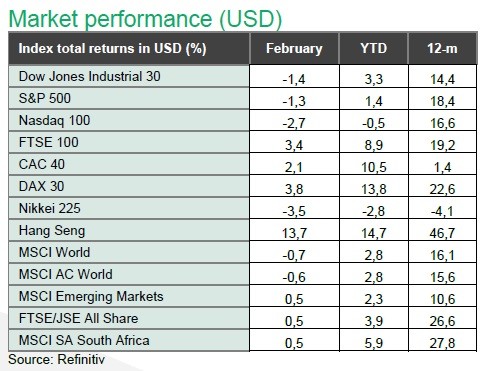

US equity markets stumbled in February as policy uncertainty, softer economic and sentiment data and questions on the sustainability of US technology earnings weighed on investor’s minds. The US House of Representatives agreed a budget resolution, which extends the promised 2017 tax cuts, but with a trade off on the spending side, prompting concerns that expenditure cuts could impact critical programmes such as Medicaid. European markets fared better, albeit from a low base, with policy accommodation still at play, and geopolitics offering a possible end to the Russia-Ukraine conflict, increased fiscal (and military) spend and in aggregate, an improved growth outlook. Chinese technology stocks rallied strongly over the month, lifting local equity indices, while a weaker USD provided an additional boost for emerging market indices.

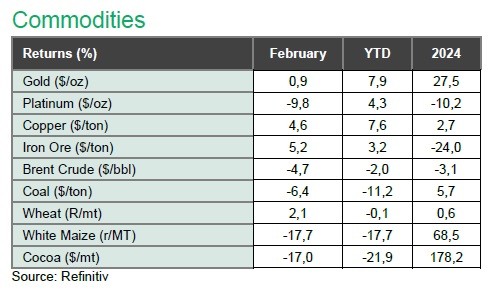

Increased supply from OPEC+ members from April and escalating growth concerns following US tariff announcements on China (10%), Canada and Mexico (25%), saw the oil price decrease by 4,7% over the month. European gas prices declined by 17,2% in February as peace talks between the US and Russia (and Europe) developed over the month.

US inflation data continued to paint a mixed picture. US headline inflation rose for a fourth consecutive month to 3,0% y-o-y in January, above market expectations, while core inflation also edged up to 3,3%. Producer prices remained steady at 3,5%, also above market expectations. More constructively, data for the US personal consumption expenditure price index (PCE) was recorded at 2,5%, the first decline in several months.

The annual rate for core PCE (the Fed’s preferred measure of inflation) also eased to 2,6%, in line with expectations. Consumer inflation expectations from survey data have been on the increase, a factor that will be of concern to policy makers, even if political affiliation may be playing a big role in shaping perceptions.

Inflation for the Euro area eased to 2,4% y-o-y in February from 2,5% the previous month, slightly above market expectations as services and energy costs eased. German elections delivered historic results. Voter turnout was 82,5%, the highest level in decades, while votes for the left and right saw the incumbent centrist parties lose meaningful ground. Nonetheless, the Christian Democratic Union (CDU), led by Friedrich Merz, won the election but will need to form a coalition government for a majority. This would be achievable alongside the Social Democrats (SPD), although will not afford them the absolute majority required to pass anticipated fiscal reforms and higher defence spending. A negotiated outcome alongside another partner may be required.

UK inflation printed at 3,0% in January from 2,5% the previous month, with wage data showing upward pressure. The Bank of England (BoE) cut interest rates by 25bps in February, bringing the policy rate to 4,5%. Chinese inflation printed at 0,5% over the year from 0,1% the prior month, reflecting seasonal spending trends around the Lunar New Year and arguably some benefit from recent stimulus measures. Producer prices, however, continued to languish in deflationary territory, falling by 2,3% y-o-y in January. While firmer inflation data and tariff proposals simmer in the background, softer US economic and sentiment data refocused market attention on growth concerns. The US 10-year bond yield declined to 4,2% by month end. Sovereign bond markets benefitted from this shift in focus, with the Bloomberg Global Aggregate Bond index returning 1,4% in February, supporting gains of 2,0% year to date. Gold continued to benefit from the precarious global backdrop, while the US dollar depreciated 0,7% on a trade weighted basis.

Want to know more?

Here's what to do:

- Contact your wealth manager or stockbroker.

- To find out more about our investment offering, click here.

- If you're interested in what we can offer you, we would love to hear from you. You can contact us on 0800 111 263, or complete an online contact form.

| Disclaimer |

Nedgroup Private Wealth (Pty) Ltd and its subsidiaries (Nedbank Private Wealth) issued this communication. Nedgroup Private Wealth is a subsidiary of Nedbank Group Limited, the holding company of Nedbank Limited. ‘Subsidiary’ and ‘holding company’ have the same meanings as in the Companies Act, 71 of 2008, and include foreign entities registered in terms of the act. There is an inherent risk in investing in any financial product. The information in this communication, including opinions, calculations, projections, monetary values and interest rates, are guidelines or estimations and for illustration purposes only. Nedbank Private Wealth is not offering or inviting anyone to conclude transactions and has no obligation to update the information in this communication. While every effort has been made to ensure the accuracy of the information, Nedbank Private Wealth and its employees, directors and agents accept no liability, whether direct, indirect or consequential, arising from any reliance on this information or from any action taken or transaction concluded as a result. Subsequent transactions are subject to the relevant terms and conditions, and all risks, including tax risk, lie with you. Nedbank Private Wealth recommends that, before concluding transactions, you obtain tax, accounting, financial and legal advice. Nedbank Private Wealth includes the following entities: |

Additional Information

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.