Accessibility Links

By browsing our website, you accept the use of cookies. Our use of cookies is explained in our privacy policy.

March 2025 market review: International

European and Asian markets delivered credible returns over the first quarter as policy makers were spurred into action. Read the latest international market review.

Paring back expectations

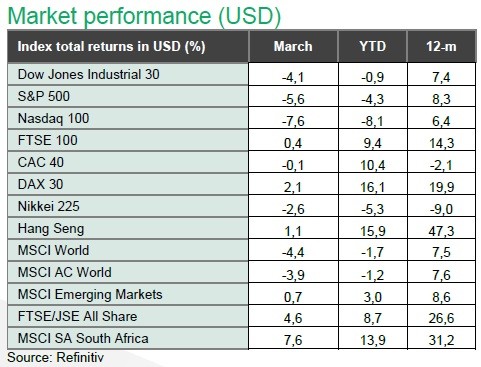

US equity markets tumbled in the first quarter of 2025, as high valuations in technology stocks were pared back and policy uncertainty and trade tensions escalated. Tariff announcements, and countermeasures in response, dominated headlines in March. The US administration also announced a global 25% tariff on all imported motor vehicles and parts.

In contrast, European and Asian markets delivered credible returns over the first quarter as policy makers were spurred into action. Europe announced increased defence spending, while Germany passed meaningful fiscal reforms, setting the region up for reinvestment in infrastructure and defence. Chinese policymakers announced a GDP target of “around 5%” for 2025, despite simmering tensions with the US.

Stimulus measures to support consumption followed later in the month, providing a boost to local stock markets. Over the quarter, Chinese equity markets rallied strongly as markets priced technology advances in the region, with the added boost from perceived government support for the sector. Additionally, a weaker USD provided a sanguine backdrop for emerging market indices and currencies.

With concerns of weaker global growth and OPEC+ members advancing plans to increase supply, oil prices have remained broadly contained, returning 0,1% over the quarter. This, despite an uptick of 2,1% in March on the back of indirect tariffs on buyers of Venezuelan oil and a reemergence of geopolitical tensions in the Middle East. Despite tight supplies, European gas prices declined further in March, as talks of a ceasefire deal between the US and Russia (and Europe) evolved. This brings the decline year to date to 16,9%, providing an additional tailwind for the region.

For another month, US inflation data painted a mixed picture. US headline inflation eased to 2,8% from 3,0% y-o-y in January, while core inflation also slowed to 3,1%. Producer prices printed at 3,2%, below forecasts. Data for the US personal consumption expenditure price index (PCE) remained steady at 2,5%. In contrast, the annual rate for core PCE (the Fed’s preferred measure of inflation) increased to 2,8%, above market expectations. Consumer inflation expectations from survey data showed another increase over the month. Federal Reserve Chair, Jerome Powell noted that longer term inflation expectations, which remain largely anchored, are most important. The deterioration of the short-term data is nonetheless noteworthy, representing a deterioration in the near-term outlook. The US Federal Reserve (US Fed) kept policy rates on hold, in line with market expectations. New economic forecasts outlined lower economic growth and higher inflation over the medium-term, but no change to the expected trajectory for the policy rate. The US 10-year bond yield traded rangebound, ending the month at 4,2%.

Inflation for the Euro area eased to 2,3% y-o-y in February from 2,5% the previous month, below market expectations as services and energy costs eased. The European Central Bank (ECB) cut the policy rates by 25bps, reflecting that disinflation was on track even if risks over the medium-term have increased. UK inflation printed at 2,8% in February from 3,0% the previous month. The Bank of England (BoE) kept interest rates unchanged in March, keeping the policy rate at 4,5%. Chinese inflation printed at -0,7% over the year after a rise of 0,5% the prior month. The deflationary print was greatly impacted by declining food prices, however, core inflation also declined over the year (-0,1%). Producer prices continued to languish in deflationary territory, falling by 2,2% y-o-y in February. With a deflationary backdrop signalling weak demand conditions, policymakers lowered the inflation target to 2,0% from 3,0%.

Despite a challenging start to the year, sovereign bond markets ended the quarter in the green with the Bloomberg Global Aggregate Bond index returning 2,6% over the quarter. Gold gained 19,0% over the quarter, reaching new highs above $3000 an ounce as investors reached for safe havens. The US dollar depreciated 3,2% in March, bringing the decline over the first quarter to 3,9% on a trade weighted basis.

Want to know more?

Here's what to do:

- Contact your wealth manager or stockbroker.

- To find out more about our investment offering, click here.

- If you're interested in what we can offer you, we would love to hear from you. You can contact us on 0800 111 263, or complete an online contact form.

| Disclaimer |

Nedgroup Private Wealth (Pty) Ltd and its subsidiaries (Nedbank Private Wealth) issued this communication. Nedgroup Private Wealth is a subsidiary of Nedbank Group Limited, the holding company of Nedbank Limited. ‘Subsidiary’ and ‘holding company’ have the same meanings as in the Companies Act, 71 of 2008, and include foreign entities registered in terms of the act. There is an inherent risk in investing in any financial product. The information in this communication, including opinions, calculations, projections, monetary values and interest rates, are guidelines or estimations and for illustration purposes only. Nedbank Private Wealth is not offering or inviting anyone to conclude transactions and has no obligation to update the information in this communication. While every effort has been made to ensure the accuracy of the information, Nedbank Private Wealth and its employees, directors and agents accept no liability, whether direct, indirect or consequential, arising from any reliance on this information or from any action taken or transaction concluded as a result. Subsequent transactions are subject to the relevant terms and conditions, and all risks, including tax risk, lie with you. Nedbank Private Wealth recommends that, before concluding transactions, you obtain tax, accounting, financial and legal advice. Nedbank Private Wealth includes the following entities: |

Additional Information

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.