Accessibility Links

By browsing our website, you accept the use of cookies. Our use of cookies is explained in our privacy policy.

April 2025 market review: International

Tariff announcements once again dominated headlines in April with the US administration raising the stakes meaningfully. Read the latest international market review.

Tariff announcements once again dominated headlines in April with the US administration raising the stakes meaningfully. On the 2nd of April, what President Trump coined Liberation Day, the US administration announced a 10% global minimum tariff, as well as reciprocal tariffs on individual countries. Implemented in full, this would take the effective US tariff rate to c. 22% from 2,4% in 2024, a level last seen in the 1930’s. Global risk assets, in particular US markets and the US dollar sold off in response. US long bond yields also edged higher, closing in on the 5,0% mark. While the move could partly be ascribed to some technical pressure linked to treasury futures trading, it nonetheless appeared on President Trumps radar and his social media posts. On the 9th April, the US administration announced a 90 day pause on the implementation of the reciprocal tariffs, for those countries that have not retaliated, to allow for trade deals to be struck.

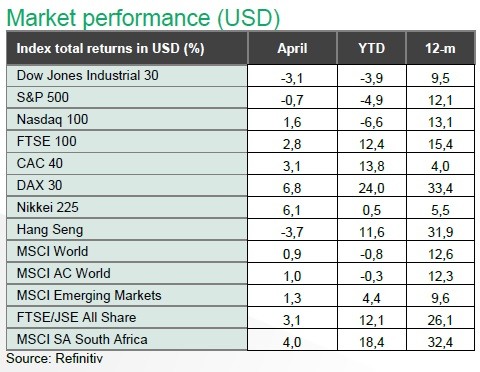

Conciliatory tones later in the month saw markets rally, all but recovering losses from earlier the month. US equity markets still ended the month in negative territory, while markets outside the US delivered credible returns despite the elevated levels of volatility. US tariffs on China now amount to 145%, while the country has responded with its own tariffs on US goods. While this weighed heavily on Chinese equity markets in the first half of the month, a credible first quarter GDP print of 5,4% and the possibility of negotiations eased tension in the latter half.

The IMF downgraded the outlook for global growth to 2,8% from 3,3% with notably downgrades to US economic growth. OPEC+ members surprised markets with a larger increase in output than expected for May, despite lacklustre prices and growing concerns around global growth. The oil price declined by 15,5% over the month, dropping to $63 per barrel by month end. Further meetings between the US and Ukraine seemingly brought progress to the prospect of a ceasefire deal. Russia announced a three-day ceasefire coinciding with the end of World War II celebration in May, although many believe this to merely be an attempt to get certain sanctions lifted. More tangible was the minerals deals concluded between the US and Ukraine, while perhaps symbolically, the US approved $50m worth of ammunition sales to the country. European gas prices continued its decline by a further 21,0% in April, bringing the price movement year to date to -34,3%.

US headline inflation eased to 2,4% from 2,8% y-o-y in March, while core inflation also slowed to 2,8%. Producer prices printed at 2,7%, below forecasts. Data for the US personal consumption expenditure price index (PCE) declined to 2,3%, while the annual rate for core PCE (the Fed’s preferred measure of inflation) also decreased to 2,6%. US consumer surveys showed ongoing deterioration in the near-term outlook. The University of Michigan survey showed a meaningful downturn in consumer sentiment in April, while one year inflation expectations jumped to 6,5%, the highest since 1981. Inflation for the Euro area eased to 2,2% y-o-y in March from 2,3% the previous month. The European Central Bank (ECB) cut the policy rate by 25bps, reflecting on inflation prints that are nearing the 2% inflation target. The central bank also noted a weaker growth outlook given medium-term risks, easing expectations for future interest rate cuts. UK inflation printed at 2,6% in March from 2,8% the previous month, paving the way for another interest rate cut. Chinese inflation printed at -0,1% over the year, an improvement from the -0,7% the prior month, while core inflation printed at 0,5%. Producer prices continued to languish in deflationary territory, falling by 2,5% y-o-y in March.

Global sovereign bonds gained over the month, with the Bloomberg Global Aggregate Bond index returning 2,9%, driven by markets outside the US, notably European bonds. This brings the returns year to date to 5,7%. The tumultuous backdrop saw safe havens in vogue. Gold gained 5,3% in April, reaching new intramonth highs above $3500, with returns year to date now at 25,3%. The Japanese yen and Euro gained against the US dollar. The US dollar depreciated 4,6% in April, bringing the decline year to date to 8,3% on a trade weighted basis.

Want to know more?

Here's what to do:

- Contact your wealth manager or stockbroker.

- To find out more about our investment offering, click here.

- If you're interested in what we can offer you, we would love to hear from you. You can contact us on 0800 111 263, or complete an online contact form.

| Disclaimer |

Nedgroup Private Wealth (Pty) Ltd and its subsidiaries (Nedbank Private Wealth) issued this communication. Nedgroup Private Wealth is a subsidiary of Nedbank Group Limited, the holding company of Nedbank Limited. ‘Subsidiary’ and ‘holding company’ have the same meanings as in the Companies Act, 71 of 2008, and include foreign entities registered in terms of the act. There is an inherent risk in investing in any financial product. The information in this communication, including opinions, calculations, projections, monetary values and interest rates, are guidelines or estimations and for illustration purposes only. Nedbank Private Wealth is not offering or inviting anyone to conclude transactions and has no obligation to update the information in this communication. While every effort has been made to ensure the accuracy of the information, Nedbank Private Wealth and its employees, directors and agents accept no liability, whether direct, indirect or consequential, arising from any reliance on this information or from any action taken or transaction concluded as a result. Subsequent transactions are subject to the relevant terms and conditions, and all risks, including tax risk, lie with you. Nedbank Private Wealth recommends that, before concluding transactions, you obtain tax, accounting, financial and legal advice. Nedbank Private Wealth includes the following entities: |

Additional Information

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.