Accessibility Links

By browsing our website, you accept the use of cookies. Our use of cookies is explained in our privacy policy.

August 2024 market review: International

Market volatility flared up in August as disappointing US economic data. Read the latest market review.

Unwinding the status quo

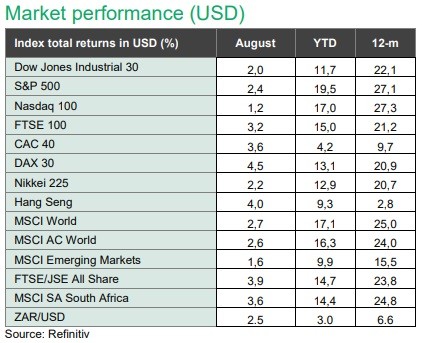

Market volatility flared up in August as disappointing US economic data and an interest rate hike from the Bank of Japan sparked a broad equity market sell- off. Markets with recent gains were particularly vulnerable to profit taking. Noteworthy daily drawdowns were seen in Japanese equities, while the Nasdaq 100 suffered as technology stocks making up the “Magnificent Seven” were particularly hard hit in the sell off, given high starting valuations. Expectations for more meaningful policy easing by the US Federal Reserve, however, saw equity markets rebound by month end. Bond markets broadly benefitted from the initial flight to safety, with added support from the interest rate recalibration.

US headline inflation decelerated to 2,9% y-o-y in July, the first print below the 3% market, while core inflation moderated to 3,2%. Producer prices printed at 2,2% from 2,7% the prior month, coming in below expectations.

Data for the US personal consumption expenditure price index (PCE) was recorded at 2,5% from 2,6% the previous month, with the annual rate for core PCE (the Fed’s preferred measure of inflation) remaining steady at 2,6% for the third month.

While the US Federal Reserve (US Fed) kept interest rates on hold once again at the end of July, it has emphasised its dual mandate of price stability and full employment, with the latter showing more strain of late. All eyes (and ears) were on the annual gathering of central bankers in Jackson Hole, Wyoming. Federal Reserve Chair, Jerome Powell, delivered a dovish message, suggesting the time has arrived for interest rate cuts. With weaker labour market data recorded over the month, markets repriced for the possibility of more meaningful interest rate action from the US Fed at the September meeting.

Inflation in the UK remained steady in June at 2,0% y-o-y, at the inflation target. While the decision was close with a 5:4 split, the backdrop of cooling inflation saw the Bank of England (BoE) cut interest rates by 25bps, the first time since 2020.

The Bank of Japan (BoJ) increased interest rates “to around 25bps” and signalled further tightening of monetary policy after a prolonged period of low interest rates. This prompted an unwind in carry trade positions, which relied on the cheap Japanese Yen borrowing cost to fund other higher yielding assets.

Despite the brutal sell off at the start of the month, risk assets rebounded swiftly on the prospect of lower interest rate and took comfort from decent second quarter earnings results. Developed market equities (2,7%) outperformed emerging market counterparts, with the MSCI Emerging Markets index returning 1,6%.

With this backdrop, the US dollar lost 2,3% on a trade weighted basis, while the Bloomberg Global Aggregate Bond index gained 2,4% in August. Interest rate sensitive sectors rallied strongly, with the global REIT markets gaining 6,2% over the month.

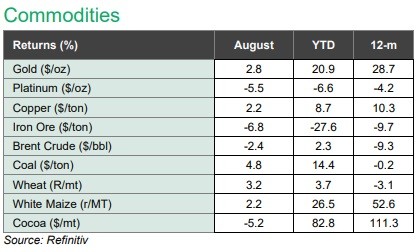

Weaker growth prospects weighed on commodity prices, with the oil price down 2,4 % over the month and iron ore marking a two year low as weak real estate conditions in China persist.

Want to know more?

Here's what to do:

- Contact your wealth manager or stockbroker.

- To find out more about our investment offering, click here.

- If you're interested in what we can offer you, we would love to hear from you. You can contact us on 0800 111 263, or complete an online contact form.

| Disclaimer |

Nedgroup Private Wealth (Pty) Ltd and its subsidiaries (Nedbank Private Wealth) issued this communication. Nedgroup Private Wealth is a subsidiary of Nedbank Group Limited, the holding company of Nedbank Limited. ‘Subsidiary’ and ‘holding company’ have the same meanings as in the Companies Act, 71 of 2008, and include foreign entities registered in terms of the act. There is an inherent risk in investing in any financial product. The information in this communication, including opinions, calculations, projections, monetary values and interest rates, are guidelines or estimations and for illustration purposes only. Nedbank Private Wealth is not offering or inviting anyone to conclude transactions and has no obligation to update the information in this communication. While every effort has been made to ensure the accuracy of the information, Nedbank Private Wealth and its employees, directors and agents accept no liability, whether direct, indirect or consequential, arising from any reliance on this information or from any action taken or transaction concluded as a result. Subsequent transactions are subject to the relevant terms and conditions, and all risks, including tax risk, lie with you. Nedbank Private Wealth recommends that, before concluding transactions, you obtain tax, accounting, financial and legal advice. Nedbank Private Wealth includes the following entities: |

Additional Information

Our investment offering

Get an income, grow and protect your wealth with our Nedbank Private Wealth investment products and services.

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.

Our investment offering

Get an income, grow and protect your wealth with our Nedbank Private Wealth investment products and services.

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.