Accessibility Links

By browsing our website, you accept the use of cookies. Our use of cookies is explained in our privacy policy.

January 2025 market review: South Africa

The US announced a 90-day suspension of funding for all foreign assistance. How did this impact the South African economy? Read our latest market review.

Externalities

The US announced a 90-day suspension of funding for all foreign assistance, which includes aid to the President’s Emergency Plan for AIDS Relief (PEPFAR) programme. This has a meaningful impact on various healthcare initiatives across 50 countries, notably in Africa and particularly in South Africa. An emergency waiver has since been approved to allow access to HIV treatment, but many programmes are however still on hold. NERSA awarded Eskom tariff increases of 12,5%, 5,4% and 6,2% for the next three financial years relative to the 36,1%,11,8% and 9,1% the entity applied for. After a reprieve of ten months, loadshedding returned temporarily at the end of the month due to increased breakdowns.

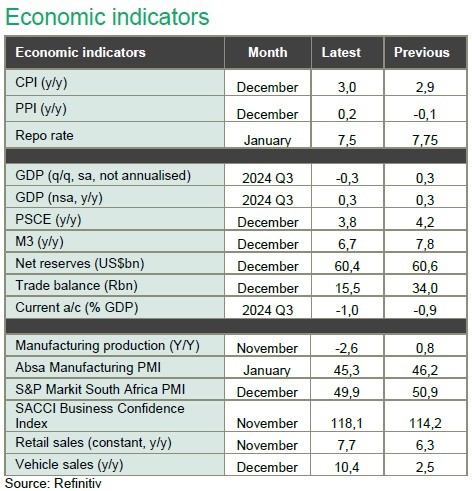

Headline inflation for the year to December 2024 printed at 3,0% from 2,9% the previous month, below expectations and at the bottom of the SARB’s target range of 3– 6%. Core inflation decreased to 3,6%. Lower fuel prices contributed to the soft yearly print, while benign food inflation and modest housing inflation contributed to softer print relative to expectations. Food inflation recorded at 1,7% from 1,6% y-o-y the prior month. This brings headline inflation for 2024 to 4,4% relative to 6,0% recorded for 2023. Stats SA published an updated inflation basket with new items that reflect updated spending habits, including air fryers, e-hailing and power banks.

Producer inflation moved out of deflationary territory, printing at 0,2%, in line with market expectations. The Monetary Policy Committee (MPC) of the South African Reserve Bank (SARB) cut the bank’s key lending rate by 25bps, in line with expectations. Four members voted in favour of a cut, while two favoured a hold. The accompanying statement highlighting greater caution given global political developments and a weaker Rand.

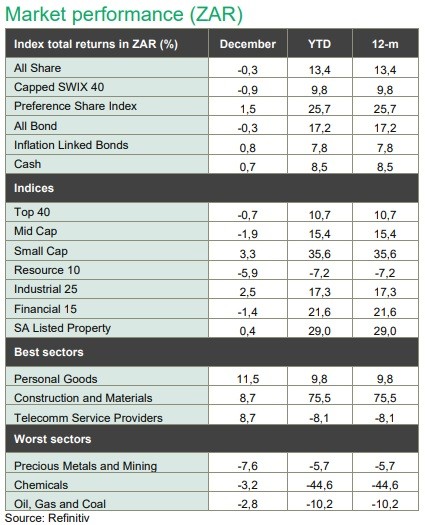

The FTSE/JSE All Bond Index gained a modest 0,4% in January, holding up against a weakening global bond market. The property sector started the year on a weak note, recording -2,3%. The Rand appreciated by 1,1% over the month, despite volatile trading conditions.

Local equity markets had a positive start to the year, with the FTSE/JSE All Share returning 2,3%. Several trends that set the tone for returns in 2024, reversed in January. Notably, resources gained 17,9%, driven by returns from precious metals (29,1%) with noteworthy returns from gold producers and platinum stocks. Industrials (1,1%) held ground, but the paring back of interest rate expectations saw financials retrace (-2,7%).

Similarly, small cap stocks (-4,6%) underperformed large and mid-cap stocks in January. Tencent started the year on the backfoot, with news that the US Department of Defence added the entity to the US Chinese Military Company list. On a more constructive note, Tencent’s Wechat was removed from the Notorious Markets List, demonstrating constructive progress with US authorities. While the direct financial impact appears limited at this stage, the headwinds of geopolitics is reflected in market pricing, despite the company responding with an accelerated buyback program. Local index bellwethers Naspers and Prosus lost 5,4% and -4,0% respectively, while Tencent retraced by 3,8%.

Want to know more?

Here's what to do:

- Contact your wealth manager or stockbroker.

- To find out more about our investment offering, click here.

- If you're interested in what we can offer you, we would love to hear from you. You can contact us on 0800 111 263, or complete an online contact form.

| Disclaimer |

Nedgroup Private Wealth (Pty) Ltd and its subsidiaries (Nedbank Private Wealth) issued this communication. Nedgroup Private Wealth is a subsidiary of Nedbank Group Limited, the holding company of Nedbank Limited. ‘Subsidiary’ and ‘holding company’ have the same meanings as in the Companies Act, 71 of 2008, and include foreign entities registered in terms of the act. There is an inherent risk in investing in any financial product. The information in this communication, including opinions, calculations, projections, monetary values and interest rates, are guidelines or estimations and for illustration purposes only. Nedbank Private Wealth is not offering or inviting anyone to conclude transactions and has no obligation to update the information in this communication. While every effort has been made to ensure the accuracy of the information, Nedbank Private Wealth and its employees, directors and agents accept no liability, whether direct, indirect or consequential, arising from any reliance on this information or from any action taken or transaction concluded as a result. Subsequent transactions are subject to the relevant terms and conditions, and all risks, including tax risk, lie with you. Nedbank Private Wealth recommends that, before concluding transactions, you obtain tax, accounting, financial and legal advice. Nedbank Private Wealth includes the following entities: |

Additional Information

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.