Accessibility Links

By browsing our website, you accept the use of cookies. Our use of cookies is explained in our privacy policy.

February 2025 market review: South Africa

Tensions between the US and South Africa escalated in February, with President Trump issuing an executive order to suspend all US funding to South Africa. Read the latest market review.

Tensions abound

Tensions between the US and South Africa escalated in February, with President Trump issuing an executive order to suspend all US funding to South Africa. The White House cited concerns around new legislation on land policy (Expropriation Act) and the country’s International Court of Justice (ICJ) case against Israel. Towards the end of the month, the US served notices to several South African organisations, that the withdrawal of US aid, including aid to the President’s Emergency Plan for AIDS Relief (PEPFAR) programme, would become final. Amidst the headlines, US Secretary of State, Marco Rubio also announced he would not be attending G20 meetings in the country.

Government unveiled a new mining cadastral system at the Mining Indaba, including a prototype, which should improve the management of mining rights and exploration for the industry. Furthering private sector involvement, Transnet Terminal Ports Authority (TNPA) signed several terminal operator agreements with private operators at Richards Bay. National Treasury published welcome amendments to regulation that governs public-private partnerships (PPP) which should expedite progress on public-private collaboration, in particular for infrastructure investment. South Africa hopes to exit the Financial Action Task Force (FATF) grey list in 2025, having made progress on 20 out of 22 items on the FATF list. The outstanding items include enforcement of regulations, notably prosecution and penalties.

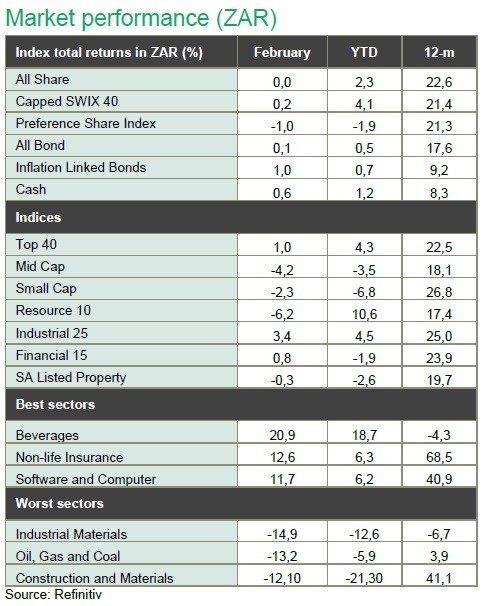

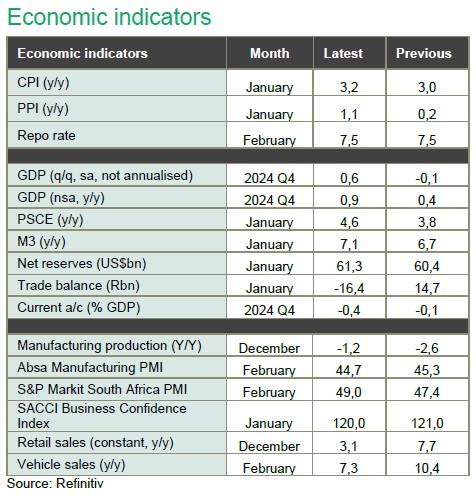

Headline inflation for the year to January 2025 printed at 3,2% from 3,0% the previous month, the first print using the new inflation basket. Core inflation decreased to 3,5%. Housing and utilities caused upward pressure, while food inflation remained benign at 1,5% from 1,7% y-o-y the prior month. Producer inflation increased in January, printing at 1,1% y-o-y, ahead of market expectations. The 2025 Budget speech was postponed to 12 March following a lack of agreement from Cabinet on certain revenue measures, notably a proposed 2% increase in VAT. The FTSE/JSE All Bond Index gained a modest 0,1% in February, with the market digesting the delay and implications of the Budget. The property sector retraced by 0,3%, perpetuating a weak start to the year. The Rand held ground over the month, depreciating by a marginal 0,1%, despite volatile trading conditions.

Local equity markets had a muted month, with the FTSE/JSE All Share flat at 0,0%. Notably, industrials gained 3,4% and financials held steady at 0,8%. Resources lost ground (-6,2%), reversing some of the previous month’s strong returns. Similarly, small cap stocks (-4,6%) and mid caps (-4,2%) underperformed large cap stocks in February.

It was a busy month for local index bellwethers Naspers and Prosus. Prosus announced a bid for food delivery business, Just Eat Takeaway for €4,1bn, one of the largest transactions for the firm in recent history. Tencent joined the Chinese technology rally over the month on growing conviction in technology advances in the region. Naspers and Prosus gained 12,3% and 11,6% respectively, while Tencent gained 19,3%.

Want to know more?

Here's what to do:

- Contact your wealth manager or stockbroker.

- To find out more about our investment offering, click here.

- If you're interested in what we can offer you, we would love to hear from you. You can contact us on 0800 111 263, or complete an online contact form.

| Disclaimer |

Nedgroup Private Wealth (Pty) Ltd and its subsidiaries (Nedbank Private Wealth) issued this communication. Nedgroup Private Wealth is a subsidiary of Nedbank Group Limited, the holding company of Nedbank Limited. ‘Subsidiary’ and ‘holding company’ have the same meanings as in the Companies Act, 71 of 2008, and include foreign entities registered in terms of the act. There is an inherent risk in investing in any financial product. The information in this communication, including opinions, calculations, projections, monetary values and interest rates, are guidelines or estimations and for illustration purposes only. Nedbank Private Wealth is not offering or inviting anyone to conclude transactions and has no obligation to update the information in this communication. While every effort has been made to ensure the accuracy of the information, Nedbank Private Wealth and its employees, directors and agents accept no liability, whether direct, indirect or consequential, arising from any reliance on this information or from any action taken or transaction concluded as a result. Subsequent transactions are subject to the relevant terms and conditions, and all risks, including tax risk, lie with you. Nedbank Private Wealth recommends that, before concluding transactions, you obtain tax, accounting, financial and legal advice. Nedbank Private Wealth includes the following entities: |

Additional Information

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.