Accessibility Links

By browsing our website, you accept the use of cookies. Our use of cookies is explained in our privacy policy.

March 2024 market review: South Africa

The South African equity market rebounded in March, with the All-Share index posting a total return of +3.2%.

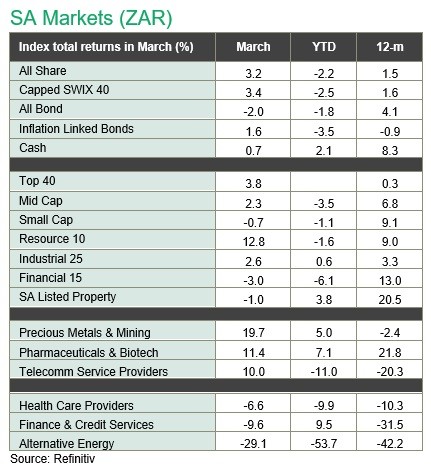

The South African equity market rebounded in March, with the All-Share index posting a total return of +3.2%. SA Listed Property and the All Bond index posted losses of -1.0% and -2.0% respectively over the month. Within the equity headline indices, Large Cap and Mid Cap stocks returned +4.1% and +2.3% respectively in March, while Small Caps posted a loss of 0.7%.

In terms of sector performance, SA Resources returned +12.8%, its best monthly performance since November 2022. SA Industrials gained 2.6% and SA Financials lost 3.0% over the month. Within SA Resources, top equity sector performance came from Precious Metals (+19.7%) with solid total returns coming from Harmony (+40.4%), Gold Fields (+22.4%), Implats (+20.9%) and Anglogold (+18.1%) driven by the rally in gold.

The outcome of South African elections to be held on 29 May and the make-up of coalitions (if any) create more uncertainty than the same time last year. For the last 30 years, SA has been a one-party-dominant state (the ANC). The expectation is that a host of new and smaller parties will eat away at the support of the existing big parties (ANC, DA, EFF).

All three of them are vulnerable. The known unknown is how much of the vote the ANC will get and, dependent on that, who will it partner with in a coalition if its support falls below 50%. The recent launch of the MK Party adds complexity to the range of outcomes. We are looking for policy continuity and certainty, while hoping for policy implementation and improvement.

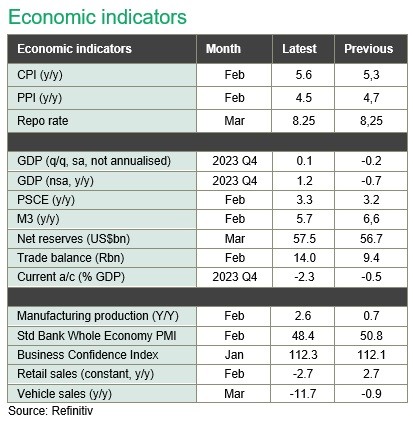

The South African Reserve Bank (SARB) is scheduled to have its next meeting on May 30th, the day after the South African elections. The expectation is that rates will be maintained at 8.25% until September when the combination of lower SA inflation prints plus rate cuts from the UK, Europe, and the US should justify a rate cut from the SARB.

Inflation in South Africa spiked to 5.6% y/y in February, from 5.3% y/y in January and 5.1% y/y in December. The overshoot relative to the forecast for 5.5% y/y was mainly due to an even higher than expected jump in medical aid tariffs.

Core inflation was also marginally higher than expected, at 5% y/y. Expectations are for a moderation of food price increases. This, together with anticipated rate cuts (moderate) will be supportive of improved consumer demand in the latter half of the year.

As always, we remain committed to providing you with the best possible investment outcomes while remaining true our long term, well considered approach and making sure that portfolios are positioned appropriately for a variety of likely outcomes.

Want to know more?

Here's what to do:

- Contact your wealth manager or stockbroker.

- To find out more about our investment offering, click here.

- If you're interested in what we can offer you, we would love to hear from you. You can contact us on 0800 111 263, or complete an online contact form.

| Disclaimer |

Nedgroup Private Wealth (Pty) Ltd and its subsidiaries (Nedbank Private Wealth) issued this communication. Nedgroup Private Wealth is a subsidiary of Nedbank Group Limited, the holding company of Nedbank Limited. ‘Subsidiary’ and ‘holding company’ have the same meanings as in the Companies Act, 71 of 2008, and include foreign entities registered in terms of the act. There is an inherent risk in investing in any financial product. The information in this communication, including opinions, calculations, projections, monetary values and interest rates, are guidelines or estimations and for illustration purposes only. Nedbank Private Wealth is not offering or inviting anyone to conclude transactions and has no obligation to update the information in this communication. While every effort has been made to ensure the accuracy of the information, Nedbank Private Wealth and its employees, directors and agents accept no liability, whether direct, indirect or consequential, arising from any reliance on this information or from any action taken or transaction concluded as a result. Subsequent transactions are subject to the relevant terms and conditions, and all risks, including tax risk, lie with you. Nedbank Private Wealth recommends that, before concluding transactions, you obtain tax, accounting, financial and legal advice. Nedbank Private Wealth includes the following entities:

|

Additional Information

Our investment offering

Get an income, grow and protect your wealth with our Nedbank Private Wealth investment products and services.

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.

Our investment offering

Get an income, grow and protect your wealth with our Nedbank Private Wealth investment products and services.

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.