Accessibility Links

By browsing our website, you accept the use of cookies. Our use of cookies is explained in our privacy policy.

March 2025 market review: South Africa

Economic growth firmed to 0,6% in the fourth quarter of 2024, benefitting from increased consumer spending. Read our latest market review.

Finding common ground

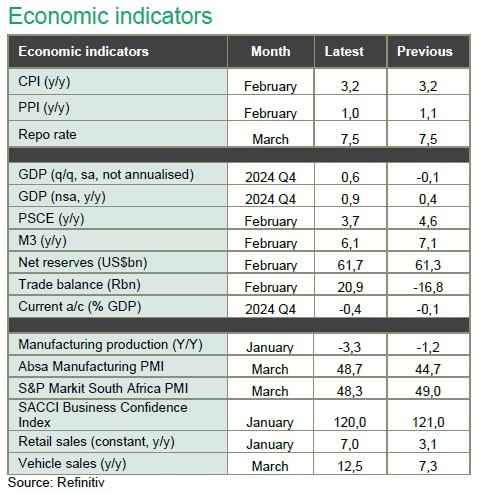

Economic growth firmed to 0,6% in the fourth quarter of 2024, benefitting from increased consumer spending and modest improvement in private sector fixed investment. This brings economic growth for 2024 to a paltry 0,6%. The current account narrowed over the fourth quarter, supported by an improved goods trade surplus, which benefitted from higher gold exports. Economic and survey data for the first quarter has thus far been mixed, with weaker survey data reflecting uncertainty related to US-SA tensions a cause for concern. The expulsion of Ebrahim Rasool, South Africa’s ambassador to the US, escalated tensions between the countries. The Department of Transport launched a formal process, including an online platform, to encourage private sector participation. Transnet agreed above inflation wages with unions over the next three years.

Headline inflation for the year to February 2025 printed at 3,2%, steady from the previous month and below market expectations. Core inflation decreased to 3,4%. Housing and utilities still made the most significant contribution to the headline figure, while medical insurance caused upward pressure over the month. Despite an increase over the month, food inflation remains benign at 1,9%. The Monetary Policy Committee (MPC) of the South African Reserve Bank (SARB) kept the bank’s key lending rate unchanged, in line with expectations. Four members voted in favour hold, while two favoured a cut. The accompanying statement highlighted a contained inflation outlook and outlined the impact of various scenarios such as the loss of AGOA benefits and weaker US growth.

Finance minister, Enoch Godongwana tabled a revised version of the Budget 2025. The commitment to fiscal consolidation remained a priority, however, revenue measures in the form of taxes still featured prominently. The most notable changes included increases in VAT of 0,5% in 2025 and 2026 and no inflationary relief for salary bands, often referred to as bracket creep. With the approval process of the Budget 2025 resting on a meeting of minds between GNU partners, uncertainty remained as an overhang. The FTSE/JSE All Bond Index gained a modest 0,7% over the quarter. The Rand demonstrated resilience over the quarter, appreciating by a 3,0% against the weaker US dollar, although lost ground against a stronger Euro, depreciating by 1,5%.

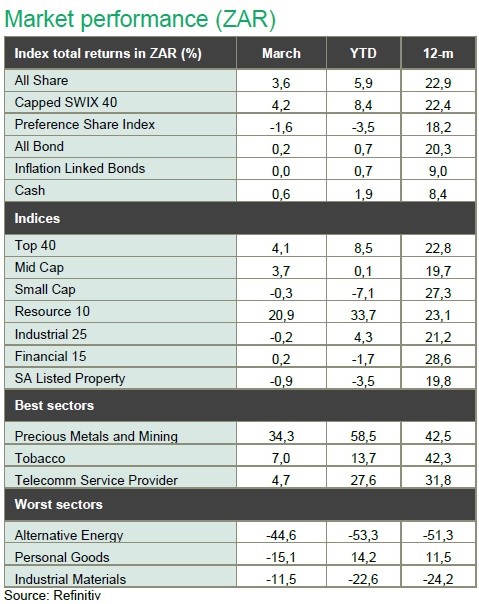

Local equity markets delivered positive results in the first quarter, with the FTSE/JSE All Share gaining 3,6%. Strong quarterly returns from resources (33,7%) was the primary contributor. Precious metals gained 58,5% over Q1, with gold and platinum producers galvanising a strong start to the year. Tencent (19,2%) benefitted from the Chinese technology rally over the quarter, with Naspers and Prosus gaining 8,3% and 12,4% respectively.

In contrast, retailers lost ground (-20,3%) as investors digest tax proposals put forward in the Budget. Small cap (-7,1%) and mid-caps (0,1%) stocks underperformed large cap stocks over the quarter. Despite a constructive results season thus far, the property sector had a weak start to the year, declining by 3,5% in the first quarter.

Want to know more?

Here's what to do:

- Contact your wealth manager or stockbroker.

- To find out more about our investment offering, click here.

- If you're interested in what we can offer you, we would love to hear from you. You can contact us on 0800 111 263, or complete an online contact form.

| Disclaimer |

Nedgroup Private Wealth (Pty) Ltd and its subsidiaries (Nedbank Private Wealth) issued this communication. Nedgroup Private Wealth is a subsidiary of Nedbank Group Limited, the holding company of Nedbank Limited. ‘Subsidiary’ and ‘holding company’ have the same meanings as in the Companies Act, 71 of 2008, and include foreign entities registered in terms of the act. There is an inherent risk in investing in any financial product. The information in this communication, including opinions, calculations, projections, monetary values and interest rates, are guidelines or estimations and for illustration purposes only. Nedbank Private Wealth is not offering or inviting anyone to conclude transactions and has no obligation to update the information in this communication. While every effort has been made to ensure the accuracy of the information, Nedbank Private Wealth and its employees, directors and agents accept no liability, whether direct, indirect or consequential, arising from any reliance on this information or from any action taken or transaction concluded as a result. Subsequent transactions are subject to the relevant terms and conditions, and all risks, including tax risk, lie with you. Nedbank Private Wealth recommends that, before concluding transactions, you obtain tax, accounting, financial and legal advice. Nedbank Private Wealth includes the following entities: |

Additional Information

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.