Accessibility Links

By browsing our website, you accept the use of cookies. Our use of cookies is explained in our privacy policy.

April 2025 market review: South Africa

In early April, the fiscal framework for the Budget was adopted in parliament by a slim majority (194 to 182 votes). Read the latest South African market review.

Finding common ground 3.0

South Africa was not immune to the global disruptions. The country could face a 30% reciprocal tariff on exports to the US, although exemptions were granted for certain minerals and metals such as platinum group metals. Sectors that will be hardest hit include the agriculture sector, notably citrus, and the automotive industry. Policy makers have started engagements, but this will happen against a backdrop of recent US-SA diplomatic tensions.The IMF downgraded its economic growth outlook for South Africa to 1,0% from 1,5% in 2025, while also decreasing the 2026 forecasts to 1,3%. The entity highlighted upward pressure on debt metrics if fiscal prudence is not applied.

In early April, the fiscal framework for the Budget was adopted in parliament by a slim majority (194 to 182 votes). Ongoing resistance to the proposed 0,5% VAT increase and questions on the constitutionality thereof brought uncertainty to the implementation of the current budget and the future of the Government of National Unity (GNU). A looming court ruling upended the budget impasse, leading to an out of court settlement between the ANC and DA. Finance minister, Enoch Godongwana subsequently announced the withdrawal of the proposed 0,5% VAT increase that was due to come into effect on 1 May 2025. While the finance minister reiterated the commitment to fiscal consolidation, a downgrade in growth prospects as well as fewer tax measures imply lower revenues, possibly further expenditure cuts and a more challenging balancing act overall. The finance minister will table a revised budget on 21 May.

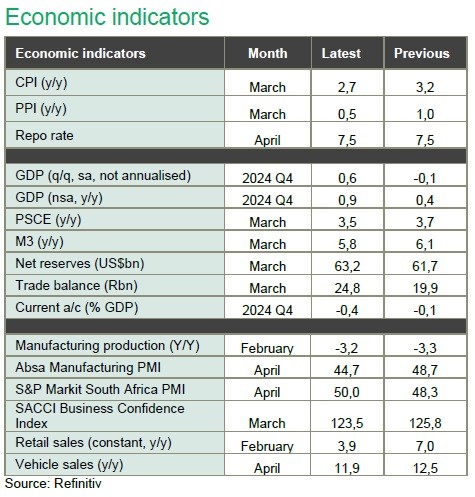

Headline inflation for the year to March 2025 printed at 2,7%, down from the previous print of 3,2% and below market expectations. The downside surprise is largely due to more benign growth in surveyed education fees. Housing and utilities still made the most significant contribution to the headline figure, while lower fuel prices helped over the month. Despite another increase over the month, food inflation remains benign at 2,2%. Core inflation decreased to 3,1%. Producer inflation slowed to 0,5% from 1,0% in February, with lower fuel prices the main driver.

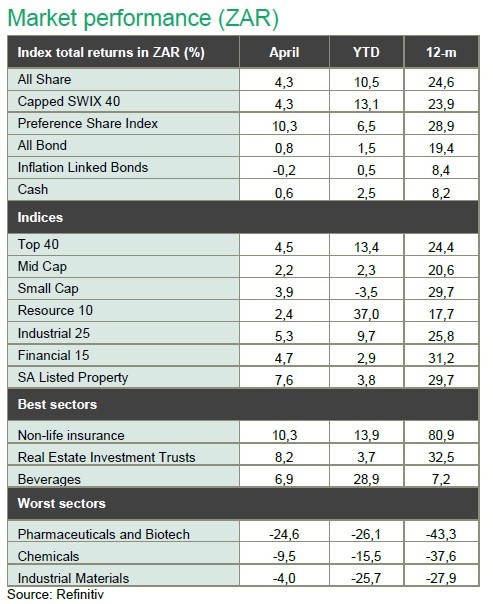

The FTSE/JSE All Bond Index gained a modest 0,8% in April, with bonds strengthening into month end. Despite big swings that saw the Rand above the R19,70 mark against the US dollar, the currency gained ground in the second half of the month and depreciated by a more modest 1,6% in aggregate. After the global sell off in early April, local equity markets regained ground, with the FTSE/JSE All Share gaining 4,3% over the month. In contrast to the first quarter, the recovery was not isolated to resources (2,4%), but saw strength across industrials (5,3%) and financial sectors (4,7%). Large caps outperformed mid and small-caps, although all ended the month in positive territory.

Things were not rosy for all though. Aspen announced a contract dispute that could possibly impact earnings in the manufacturing business by up to R2bn. The company’s share price declined by 26% over the month. After a dismal start to the year, the property sector rebounded, gaining 7,6% in April.

Want to know more?

Here's what to do:

- Contact your wealth manager or stockbroker.

- To find out more about our investment offering, click here.

- If you're interested in what we can offer you, we would love to hear from you. You can contact us on 0800 111 263, or complete an online contact form.

| Disclaimer |

Nedgroup Private Wealth (Pty) Ltd and its subsidiaries (Nedbank Private Wealth) issued this communication. Nedgroup Private Wealth is a subsidiary of Nedbank Group Limited, the holding company of Nedbank Limited. ‘Subsidiary’ and ‘holding company’ have the same meanings as in the Companies Act, 71 of 2008, and include foreign entities registered in terms of the act. There is an inherent risk in investing in any financial product. The information in this communication, including opinions, calculations, projections, monetary values and interest rates, are guidelines or estimations and for illustration purposes only. Nedbank Private Wealth is not offering or inviting anyone to conclude transactions and has no obligation to update the information in this communication. While every effort has been made to ensure the accuracy of the information, Nedbank Private Wealth and its employees, directors and agents accept no liability, whether direct, indirect or consequential, arising from any reliance on this information or from any action taken or transaction concluded as a result. Subsequent transactions are subject to the relevant terms and conditions, and all risks, including tax risk, lie with you. Nedbank Private Wealth recommends that, before concluding transactions, you obtain tax, accounting, financial and legal advice. Nedbank Private Wealth includes the following entities: |

Additional Information

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.