Accessibility Links

By browsing our website, you accept the use of cookies. Our use of cookies is explained in our privacy policy.

September 2024 market review: South Africa

The property sector continued its recovery, gaining 5,0% over the month. Read the South African September 2024 market review.

Cautious optimism

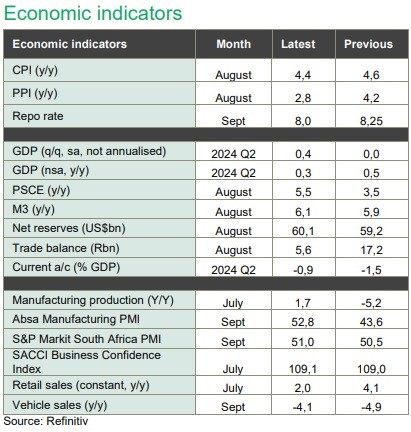

Second quarter GDP broadly met expectations, printing at 0,4% over the period. The absence of loadshedding and improvement in logistics supported the production side, while increased consumer spending helped on the expenditure side. Gross fixed capital formation remained lacklustre. The current account narrowed over the second quarter, supported by an improved goods trade surplus, which benefitted from higher export prices. While the prints were still low relative to history, both business and consumer confidence improved in the third quarter as cautious optimism around the government of national unity, lower inflation and the prospect of lower interest rates influenced sentiment. Following a post-financing assessment visit to South Africa in July, the IMF released their report in September outlining various recommendations on necessary reforms, as well as steps to stabilise and consolidate debt. This included 3,0% of expenditure cuts over three years to stabilise debt. Eskom applied to NERSA for tariff increases over the next three years, with the entity applying for a 36,2% increase in 2026. Electricity costs remain a pressure point for households and inflation.

The BER third quarter inflation expectation survey recorded a decline in inflation expectations across various participating groups (analysts, households, businesses, and unions), with expectations in the medium term at 4,8%.

Headline inflation for the year to August 2024 moderated to 4,4% from 4,6% the previous month, trending below the SARB’s midpoint of 4,5%. Core inflation also declined to 4,1% from 4,3%. A decrease in fuel prices was the most significant contributor to the monthly decline, while food inflation edged higher to 4,1% y-o-y. Producer inflation for August surprised to the downside at 2,8% from a figure of 4,2% the prior month. The deflationary trends set the scene for a constructive policy meeting. The Monetary Policy Committee (MPC) of the South African Reserve Bank (SARB) cut the bank’s key lending rate by 25bps, the first cut for this cycle. The committee lowered the inflation profile over the forecast period with the accompanying statement pointing to balanced risks to the inflation outlook.

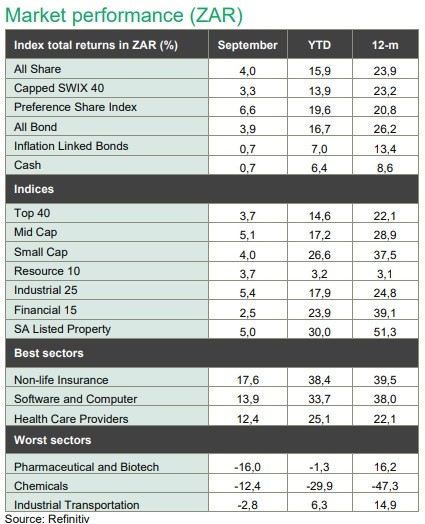

With this backdrop, domestic assets delivered positive results in the third quarter. The FTSE/JSE All Bond Index gained 3,9% over the month, benefitting from strong momentum in global bonds and cooling local inflation prints. The Rand appreciated against the US dollar by 3,1% over the month and 5,0% over the quarter.

Local equity markets also strengthened over the month, with the FTSE/JSE All Share gaining 4,0% bringing third quarter returns to 9,6%. Resources (3,7%) and industrials (5,4%) delivered positive returns, buoyed by the rally in China related assets post stimulus and cautious optimism on the local front. Index bellwethers Naspers and Prosus gained 14,1% and 14,3% respectively, moving in tandem with Chinese listed Tencent (16,4%). Small (4,0%) and mid cap stocks (5,1%) outperformed large capitalisation stocks (3,7%). The property sector continued its recovery, gaining 5,0% over the month, bringing the returns over the quarter to 18,7%, making it the best performing asset class over this period.

Want to know more?

Here's what to do:

- Contact your wealth manager or stockbroker.

- To find out more about our investment offering, click here.

- If you're interested in what we can offer you, we would love to hear from you. You can contact us on 0800 111 263, or complete an online contact form.

| Disclaimer |

Nedgroup Private Wealth (Pty) Ltd and its subsidiaries (Nedbank Private Wealth) issued this communication. Nedgroup Private Wealth is a subsidiary of Nedbank Group Limited, the holding company of Nedbank Limited. ‘Subsidiary’ and ‘holding company’ have the same meanings as in the Companies Act, 71 of 2008, and include foreign entities registered in terms of the act. There is an inherent risk in investing in any financial product. The information in this communication, including opinions, calculations, projections, monetary values and interest rates, are guidelines or estimations and for illustration purposes only. Nedbank Private Wealth is not offering or inviting anyone to conclude transactions and has no obligation to update the information in this communication. While every effort has been made to ensure the accuracy of the information, Nedbank Private Wealth and its employees, directors and agents accept no liability, whether direct, indirect or consequential, arising from any reliance on this information or from any action taken or transaction concluded as a result. Subsequent transactions are subject to the relevant terms and conditions, and all risks, including tax risk, lie with you. Nedbank Private Wealth recommends that, before concluding transactions, you obtain tax, accounting, financial and legal advice. Nedbank Private Wealth includes the following entities: |

Additional Information

Our investment offering

Get an income, grow and protect your wealth with our Nedbank Private Wealth investment products and services.

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.

Our investment offering

Get an income, grow and protect your wealth with our Nedbank Private Wealth investment products and services.

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.