Accessibility Links

By browsing our website, you accept the use of cookies. Our use of cookies is explained in our privacy policy.

October 2024 market review: South Africa

Domestic assets waned against a volatile global backdrop. Read our October 2024 market review.

A focus on reforms

The Medium-Term Budget Policy Statement (MTBPS) highlighted weaker fiscal metrics, a result of reduced revenues in addition to increased expenditure. Over the medium-term, additional funds were allocated for repayment of SANRAL debt, adjustments to Social Relief of Distress (SRD) grant and an early retirement programme for public sector workers. Despite the deterioration in budget figures, a primary balance was still achieved, and debt consolidation remains intact. High debt service costs remain a constraint, while risks, such as SOE support and a higher public sector wage agreement remain. No support was extended to Transnet in the MTBPS, but challenges (financial and operational) remain significant even with reforms underway.

Progress on reforms took the spotlight over the month. The National Transmission Company of South Africa (NTCSA) was formally launched. While still a wholly owned subsidiary of Eskom, it nonetheless pushes energy reforms forward. Transnet (and port reforms) suffered a defeat as the Durban High Court ruled in favour of AP Moller Maersk, the company that contested the bidding process that saw the concession of Durban Pier 2 awarded to the Philippines port operator ICTSI.

New visa regulations were gazetted, formalising the Remote Worker Visitors Visa and the introduction of a Points-Based System for Work Visas.

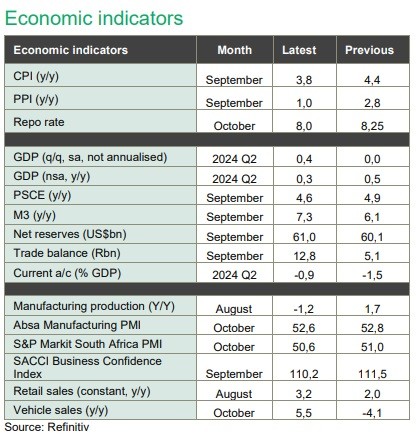

Purchasing manufacturing indices for September improved, moving strongly into expansionary territory, but hard data for the third quarter suggest modest activity thus far. Headline inflation for the year to September 2024 moderated to 3,8% from 4,4% the previous month, trending below the SARB’s midpoint of 4,5%. Core inflation remained steady at 4,1%. A decrease in fuel prices was the most significant contributor to the monthly decline, while food inflation remained at 4,1% y-o-y. Producer inflation for September surprised to the downside at 1,0% from a figure of 2,8% the prior month.

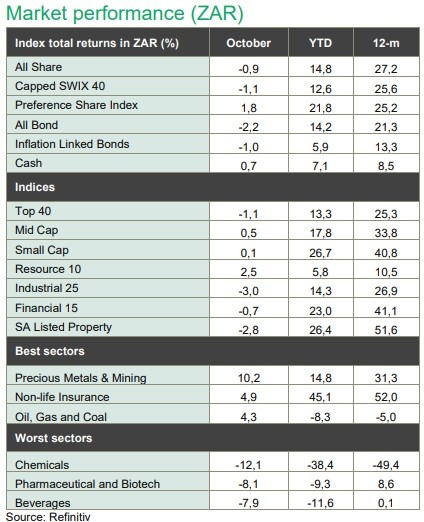

Domestic assets waned against a volatile global backdrop. Interest rate sensitive assets weakened against the increase in global bond yields. The FTSE/JSE All Bond Index weakened 2,2%, also reflecting a less than encouraging MTBPS. After a period of strength, the property sector declined by 2,8%. The Rand depreciated against a stronger US dollar by 1,7%, bringing the appreciation year to date to 3,4%.

Local equity markets also lost ground over the month, with the FTSE/JSE All Share returning -0,9%. Resources bucked the trend with positive returns of 2,5% while industrials (-3,0%) and financials (-0,7%) weakened. A strong showing in precious metals was a key driver in the recovery in resources, with strong returns across companies, including Northam, Implats, Sibanya, and Amplats. Small (0,1%) and mid cap stocks (0,5%) outperformed large capitalisation stocks (-1,1%).

The announcement from the National Development and Reform Commission (NDRC) did not meet expectations in terms of scale, although investors acknowledged the remit of the entity did not extend to new spending.

Want to know more?

Here's what to do:

- Contact your wealth manager or stockbroker.

- To find out more about our investment offering, click here.

- If you're interested in what we can offer you, we would love to hear from you. You can contact us on 0800 111 263, or complete an online contact form.

| Disclaimer |

Nedgroup Private Wealth (Pty) Ltd and its subsidiaries (Nedbank Private Wealth) issued this communication. Nedgroup Private Wealth is a subsidiary of Nedbank Group Limited, the holding company of Nedbank Limited. ‘Subsidiary’ and ‘holding company’ have the same meanings as in the Companies Act, 71 of 2008, and include foreign entities registered in terms of the act. There is an inherent risk in investing in any financial product. The information in this communication, including opinions, calculations, projections, monetary values and interest rates, are guidelines or estimations and for illustration purposes only. Nedbank Private Wealth is not offering or inviting anyone to conclude transactions and has no obligation to update the information in this communication. While every effort has been made to ensure the accuracy of the information, Nedbank Private Wealth and its employees, directors and agents accept no liability, whether direct, indirect or consequential, arising from any reliance on this information or from any action taken or transaction concluded as a result. Subsequent transactions are subject to the relevant terms and conditions, and all risks, including tax risk, lie with you. Nedbank Private Wealth recommends that, before concluding transactions, you obtain tax, accounting, financial and legal advice. Nedbank Private Wealth includes the following entities: |

Additional Information

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.